Home ownership is a big challenge facing people living in New South Wales.

Saving for a large deposit can be daunting.

The NSW Government will ease that burden for eligible applicants with the launch of the NSW Shared Equity Scheme Home Buyer Helper on 23 January 2023.

So, if you’re a single parent caring for children, single aged 50 years or older, or a first home buyer who’s employed as a key worker, check your eligibility and take the next step to owning your own home.

If you have a 2% deposit, the NSW Government will contribute up to 40% for a new home or 30% for an existing home.

Shared equity means the Government has a percentage share of your home equivalent to what they’ve contributed.

Lenders Mortgage Insurance is not required, potentially saving you additional thousands.

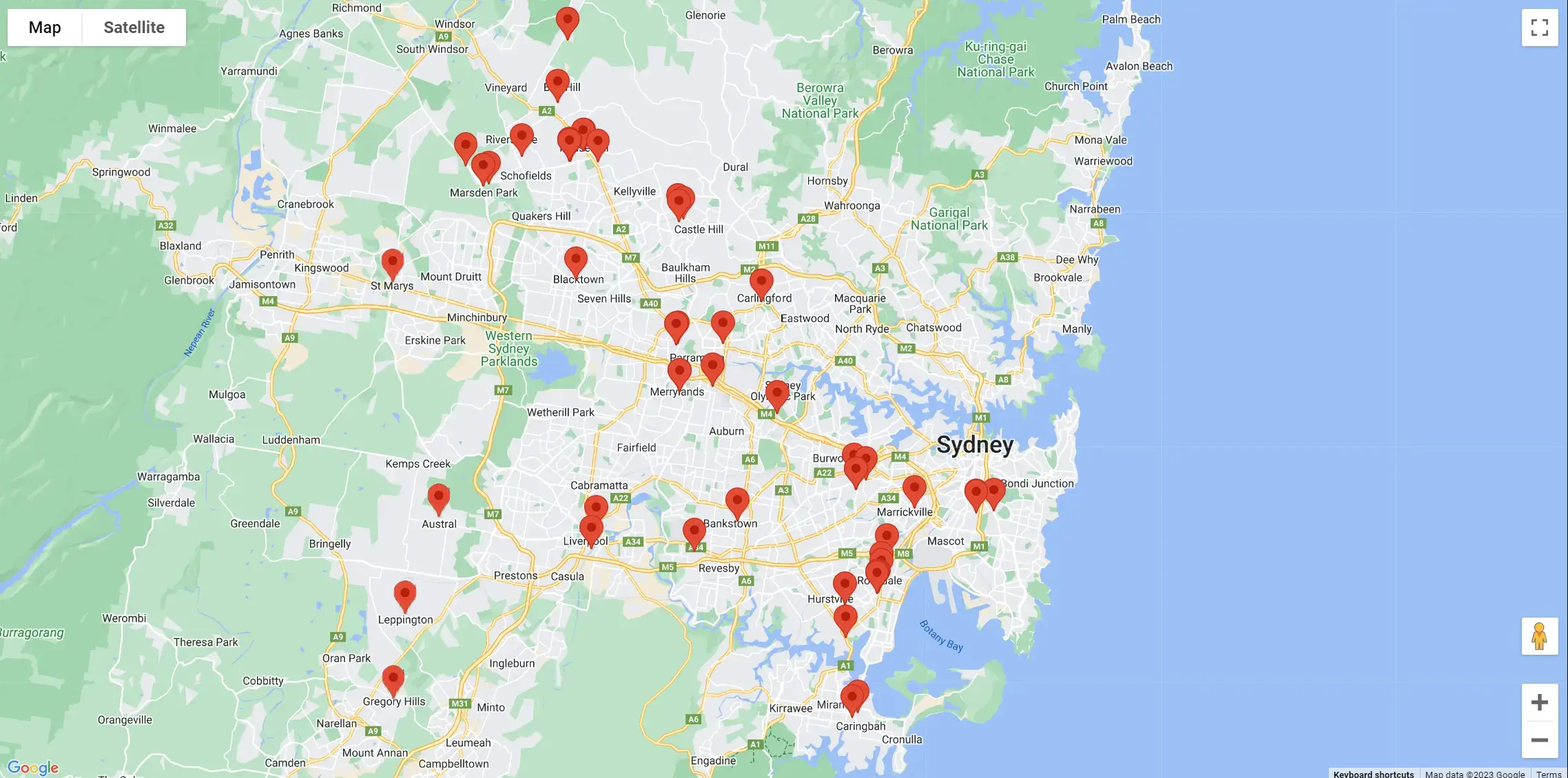

Our team of property advisors can answer any questions you may have and see what property options you have available to you under the scheme.

Explore your options available to you and then our team will put you in touch with one of our chanel partners to get your approval.

No, you cannot. You can apply for only one of these schemes at a time.

There are 3,000 places each financial year. The scheme will accept applications for two financial years (2022-23 and 2023-24)

If you’re a single parent or a single who’s over 50 and you currently own property, you will need to sell the property before you submit the final application. Please note that pre-approval expires after three months.

You can buy:

Yes. The Shared Equity Home Buyer Helper does not affect the various grants and exemptions available to first-home buyers.

You can still get your grant and stamp-duty concession.

You can make voluntary payments to reduce the state’s interest in your property. The minimum payment is 5% of the property value.

The proceeds from the sale will be paid in the following order:

The government will be paid for its interest and proportionally share the gain or loss from the sale of the property.

Suite 1005, 31 Lasso Road, Gregory Hills NSW 2557

enquiries@sreg.com.au

1300 00 SREG (7734)